Kevin McCarthy'snet worth refers to the total value of his assets minus his liabilities. For instance, if he owns stocks, bonds, or real estate worth $5 million and has $1 million in debts, his net worth would be $4 million.

Knowing a person's net worth can provide insights into their financial standing and wealth accumulation. It's often used to assess financial success and compare economic positions.

Historically, the concept of net worth has evolved from simple accounting methods to more sophisticated financial analysis tools. Today, it remains a crucial indicator of financial well-being.

- Lara Rose Onlyfans The Rise Of A Digital Sensation

- Baldwin Brothers Exploring The Legacy Of Hollywoods Most Talented Siblings

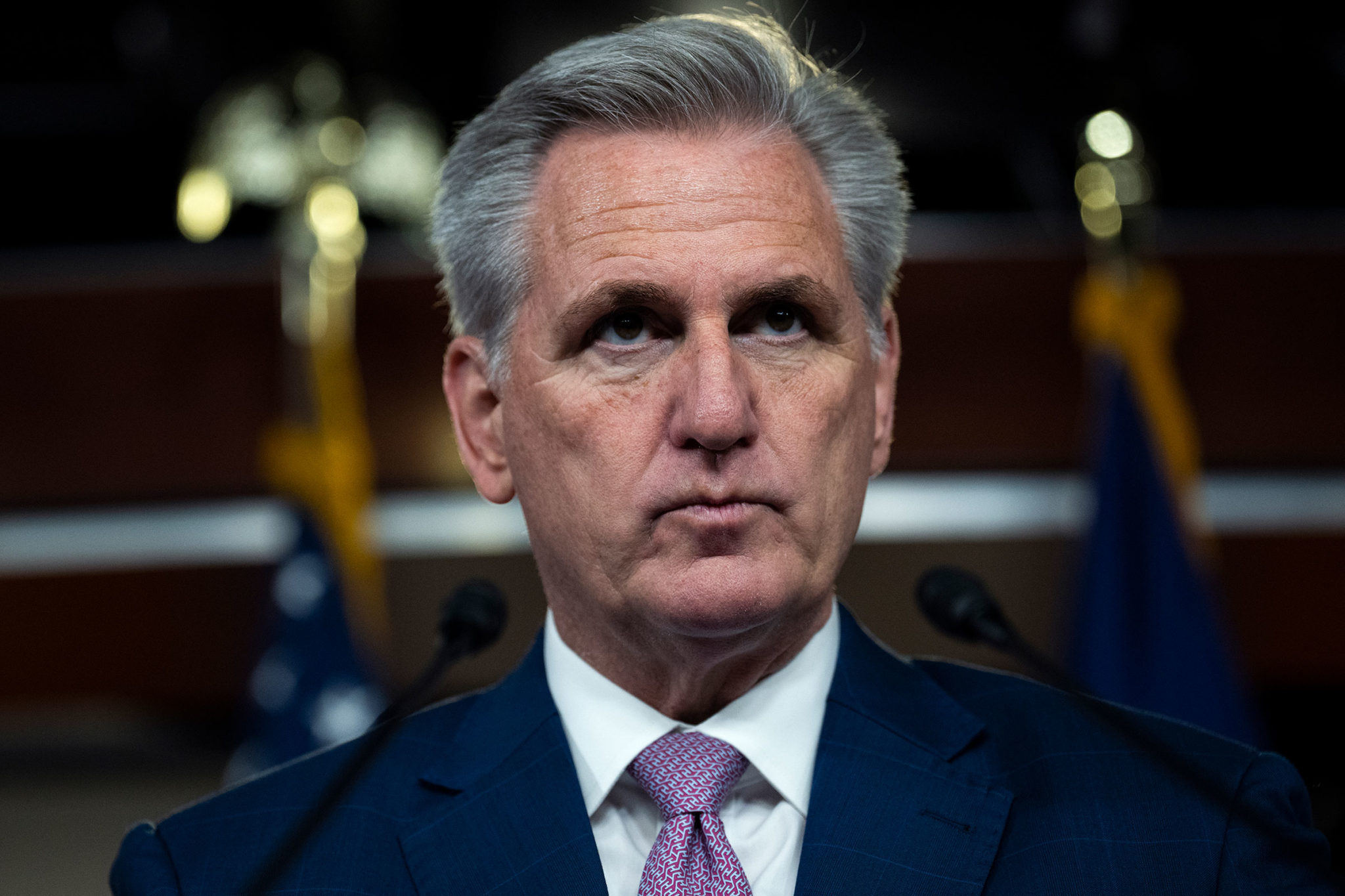

Kevin McCarthy Net Worth

Understanding the essential aspects of Kevin McCarthy's net worth provides insights into his financial standing and wealth accumulation.

- Assets

- Liabilities

- Income

- Investments

- Debt

- Cash Flow

- Financial Goals

- Estate Planning

- Tax Implications

These aspects are interconnected and influence his overall financial well-being. For example, his assets and liabilities determine his net worth, while his income and investments can impact his net worth over time. Understanding these aspects can provide a comprehensive view of Kevin McCarthy's financial situation.

| Name | Kevin McCarthy |

|---|---|

| Age | 59 |

| Occupation | Politician |

| Political Party | Republican |

| Education | California State University, Bakersfield |

Assets

Understanding the composition of Kevin McCarthy's assets is crucial for assessing his financial standing. Assets encompass all resources and possessions that have economic value and can be converted into cash.

- Best Remote Iot Vpc Ssh Raspberry Pi Free Setup Guide

- Picuki The Ultimate Guide To Enhancing Your Instagram Experience

- Cash and Cash Equivalents

This includes physical cash, checking and savings accounts, and money market accounts. These assets are highly liquid and can be easily accessed.

- Investments

These include stocks, bonds, mutual funds, and real estate. Investments can generate income through dividends, interest, or appreciation in value.

- Retirement Accounts

These include 401(k) plans, IRAs, and pensions. Retirement accounts are tax-advantaged and intended for long-term savings.

- Personal Property

This includes items such as cars, jewelry, art, and collectibles. Personal property can have sentimental or monetary value.

The composition of Kevin McCarthy's assets provides insights into his financial strategy and risk tolerance. A diversified portfolio of assets can help mitigate risk and preserve wealth over time.

Liabilities

Liabilities are financial obligations that reduce Kevin McCarthy's net worth. Understanding his liabilities provides insights into his financial leverage and risk profile.

- Debt

Debt refers to money owed to creditors, such as mortgages, personal loans, and credit card balances. High levels of debt can strain cash flow and limit financial flexibility.

- Accounts Payable

These are short-term debts owed to suppliers or vendors for goods or services received but not yet paid for.

- Taxes Payable

These are taxes owed to government entities, such as income tax, property tax, and sales tax. Unpaid taxes can lead to penalties and legal consequences.

- Deferred Revenue

This is revenue received in advance for goods or services that have not yet been delivered. It creates a liability until the goods or services are provided.

The composition and level of Kevin McCarthy's liabilities influence his overall financial health. High levels of debt and other liabilities can limit his ability to invest and grow his net worth. Managing liabilities effectively is essential for maintaining a sound financial position.

Income

Income plays a crucial role in determining Kevin McCarthy's net worth. It represents the inflow of funds that increase his overall financial standing.

- Salary and Wages

As a politician, McCarthy earns a salary from his position in the United States House of Representatives. This is a stable and regular source of income.

- Investments

McCarthy may have invested a portion of his wealth in stocks, bonds, or real estate. These investments can generate income through dividends, interest, or capital gains.

- Speaking Engagements

As a public figure, McCarthy may receive compensation for speaking at events or conferences. These engagements can provide an additional source of income.

- Royalties

If McCarthy has written books or created other intellectual property, he may earn royalties on sales or licensing fees.

Understanding the sources and stability of Kevin McCarthy's income provides insights into his financial security and ability to grow his net worth over time.

Investments

Investments represent a significant component of Kevin McCarthy's net worth, contributing to its growth and stability. Through strategic allocation of funds into various investment vehicles, he can potentially multiply his wealth over time.

- Stocks

Stocks represent ownership shares in publicly traded companies. McCarthy may invest in stocks to gain exposure to potential growth and dividend income.

- Bonds

Bonds are fixed-income securities that provide regular interest payments. McCarthy may invest in bonds to generate a steady income stream and preserve capital.

- Real Estate

Real estate investments can include residential and commercial properties. McCarthy may invest in real estate to generate rental income, capital appreciation, and tax benefits.

- Private Equity

Private equity involves investments in privately held companies that are not publicly traded. McCarthy may invest in private equity to gain access to high-growth potential and diversify his portfolio.

McCarthy's investment strategy and allocation decisions influence the risk-return profile of his net worth. Diversifying across different asset classes and investment types can help mitigate risk and enhance the overall performance of his investment portfolio.

Debt

Debt represents a crucial aspect of Kevin McCarthy's net worth, reflecting his financial obligations and leverage. Understanding the various facets of his debt can provide insights into his financial risk profile and overall financial health.

- Mortgages

Mortgages are loans secured by real estate, typically used to finance the purchase of a home or investment property. McCarthy's mortgage debt can impact his monthly cash flow and overall financial leverage.

- Personal Loans

Personal loans are unsecured loans used for various purposes, such as debt consolidation, home renovations, or unexpected expenses. McCarthy's personal loan debt can indicate his need for additional financing or potential cash flow challenges.

- Credit Card Debt

Credit card debt is a common form of revolving debt that can accumulate over time if not managed responsibly. High credit card debt can negatively impact McCarthy's credit score and increase his interest payments.

- Business Debt

If McCarthy has any business ventures or investments, he may have incurred business debt to finance operations or expansion. Business debt can affect his personal finances if his businesses experience financial difficulties.

The level and composition of Kevin McCarthy's debt can influence his financial flexibility, investment decisions, and overall financial well-being. Managing debt effectively is essential for maintaining a sound financial position and maximizing his net worth over time.

Cash Flow

Cash flow plays a critical role in determining Kevin McCarthy's net worth. Positive cash flow, where the inflow of funds exceeds the outflow, contributes to the growth of his net worth. Conversely, negative cash flow can deplete his financial resources and hinder his ability to accumulate wealth.

McCarthy's cash flow is influenced by various factors, including his income, investments, and expenses. Stable and predictable income streams, such as his salary as a politician, provide a solid foundation for positive cash flow. Additionally, income generated from investments, such as dividends or rental income, can further enhance his cash flow.

Understanding cash flow is essential for McCarthy to make informed financial decisions. By tracking his cash flow, he can identify areas where he can optimize his income and reduce expenses, thus improving his financial position. Effective cash flow management can also help him plan for future investments and financial goals.

Financial Goals

Financial goals are a crucial aspect of Kevin McCarthy's net worth, guiding his financial decisions and shaping his overall financial well-being. These goals encompass a range of objectives, from short-term targets to long-term aspirations.

- Retirement Planning

Ensuring a financially secure retirement is a common financial goal. McCarthy may set aside funds in retirement accounts, such as 401(k) plans or IRAs, to accumulate savings for his post-retirement years.

- Wealth Accumulation

Growing his net worth over time is likely a key financial goal for McCarthy. This can involve making wise investment decisions, maximizing income streams, and minimizing unnecessary expenses.

- Debt Repayment

Managing debt effectively can contribute to McCarthy's financial goals. He may prioritize paying down high-interest debts to reduce his overall debt burden and improve his cash flow.

- Tax Optimization

Understanding and utilizing tax-advantaged strategies can help McCarthy optimize his financial returns. This may involve maximizing contributions to tax-deductible accounts or exploring tax-efficient investment options.

By setting and working towards well-defined financial goals, Kevin McCarthy can navigate the complexities of wealth management, make informed financial decisions, and ultimately build a solid financial foundation for the future.

Estate Planning

Estate planning plays a significant role in managing Kevin McCarthy's net worth and ensuring the distribution of his assets according to his wishes after his lifetime. It involves strategies and legal arrangements that help organize, preserve, and distribute wealth.

- Will or Trust

A will or trust outlines the distribution of assets after death and can minimize probate costs and delays. McCarthy can use these tools to specify how his wealth should be divided among beneficiaries. - Power of Attorney

A power of attorney designates an individual to manage McCarthy's financial and legal affairs if he becomes incapacitated. This ensures continuity in managing his net worth in case of unforeseen circumstances. - Advance Directives

Advance directives, such as a living will or healthcare proxy, allow McCarthy to express his wishes regarding medical treatment in the event of his inability to communicate. This helps ensure that his healthcare decisions align with his values. - Tax Planning

Estate planning involves tax planning to minimize the impact of estate taxes on McCarthy's net worth. Strategies like trusts and charitable giving can reduce the tax burden on his beneficiaries.

Overall, estate planning is a crucial aspect of Kevin McCarthy's net worth management. By implementing these strategies, he can ensure the preservation and distribution of his wealth according to his wishes, provide for his loved ones, and minimize the tax implications on his estate.

Tax Implications

Tax implications play a crucial role in determining Kevin McCarthy's net worth. Taxes can significantly impact his financial standing by reducing the value of his assets and income.

One of the primary ways taxes affect McCarthy's net worth is through income taxes. As his income increases, so too does his tax liability. This means that a higher proportion of his earnings must be paid to the government, reducing the amount of wealth he can accumulate.

Another significant tax implication for McCarthy is capital gains tax. When he sells assets, such as stocks or real estate, for a profit, he must pay taxes on the gains. This can reduce his net worth if the tax bill exceeds the profit made on the sale.

Understanding the tax implications associated with his financial decisions is crucial for McCarthy to maximize his net worth. By considering the tax consequences of his investments, income, and asset sales, he can make informed choices that minimize his tax liability and preserve his wealth.

In summary, Kevin McCarthy's net worth is a multifaceted indicator of his financial standing, influenced by a complex interplay of assets, liabilities, income, investments, debt, cash flow, financial goals, estate planning, and tax implications. Understanding these components provides insights into his overall wealth management strategy and risk profile.

Some key points to consider include the significance of income stability and diversification in growing his net worth, the potential impact of debt on his financial flexibility, and the importance of estate planning in preserving and distributing his wealth according to his wishes. These factors are interconnected and require careful management to maintain a sound financial position.

- Emily Osment Naked Addressing Misinformation And Highlighting Emily Osments Career

- Remote Iot Vpc Review Unlocking The Future Of Connected Systems