The "net worth of joan lunden pennbook" is a measure of her financial worth, defined as the total value of her assets minus her liabilities. For instance, if Joan Lunden's assets are worth $10 million and her debts total $2 million, her net worth would be $8 million.

Knowing a person's net worth can be significant for evaluating their financial stability and success. It can assist with assessing loan eligibility, making investment decisions, and guiding financial planning. Historically, the concept of net worth has evolved from focusing on land ownership to encompassing a wider range of assets and liabilities.

This article will delve into the complexities of Joan Lunden's net worth, exploring its composition, growth trajectory, and factors contributing to her financial success.

- Discover The World Of Divaflawless Onlyfans A Comprehensive Guide

- Alana Cho Nudes Debunking Myths And Understanding Privacy In The Digital Age

Net Worth of Joan Lunden Pennbook

Understanding the various aspects that contribute to the net worth of Joan Lunden Pennbook provides valuable insights into her financial standing and success.

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Cash Flow

- Debt

- Investment Returns

- Financial Management

Analyzing these aspects can reveal the strategies and decisions that have shaped Joan Lunden Pennbook's financial trajectory. By examining her asset allocation, investment performance, and debt management practices, we can gain a deeper understanding of her overall financial health and wealth accumulation strategies.

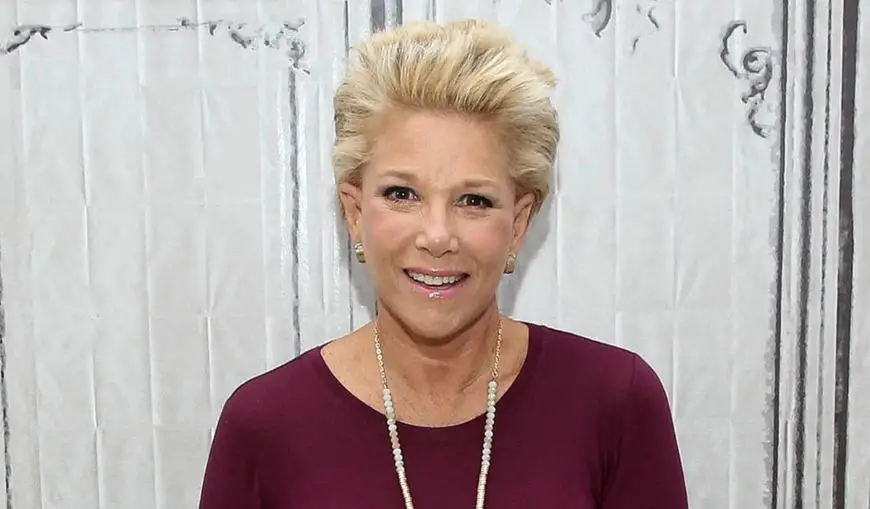

| Name | Date of Birth | Place of Birth | Occupation |

|---|---|---|---|

| Joan Lunden | September 19, 1950 | Fair Oaks, California, U.S. | Journalist, television host, and author |

Assets

Assets are a crucial component of net worth, as they represent the value of what an individual or organization owns. In the case of Joan Lunden Pennbook, her assets contribute significantly to her overall financial worth.

- Lyra Crow Leaks Unveiling The Truth Behind The Controversy

- Smart School Boy 9 The Rise Of The Future Generation

Assets can include various types of investments, such as stocks, bonds, and real estate. Additionally, physical possessions like artwork, jewelry, and collectibles can also be considered assets. These assets can appreciate in value over time, leading to an increase in net worth. Conversely, if assets depreciate, it can result in a decrease in net worth.

Understanding the composition of Joan Lunden Pennbook's assets provides valuable insights into her financial strategies. By analyzing the types of investments she holds and the diversification of her portfolio, we can gain a better understanding of her risk tolerance and investment goals. This information can be applied to make informed investment decisions and manage personal finances effectively.

Liabilities

Liabilities represent financial obligations that an individual or organization owes to others. In the context of net worth, liabilities have a direct and significant impact on Joan Lunden Pennbook's overall financial standing.

Liabilities can include various forms of debt, such as mortgages, loans, and credit card balances. When liabilities exceed assets, it can result in a negative net worth. Conversely, if liabilities are managed effectively and kept below the value of assets, it can contribute to a positive net worth. By examining the types and amounts of liabilities within Joan Lunden Pennbook's financial portfolio, we can gain insights into her debt management strategies and overall financial health.

Understanding the relationship between liabilities and net worth is crucial for making informed financial decisions. By carefully managing debt and keeping liabilities under control, individuals can protect and grow their net worth over time. This knowledge can empower readers to develop sound financial plans, assess investment opportunities, and navigate financial challenges effectively.

Investments

Investments play a critical role in shaping the net worth of Joan Lunden Pennbook. By allocating a portion of her wealth into various investment vehicles, she has the potential to generate returns that increase her overall net worth. Investments can include stocks, bonds, real estate, and other financial instruments that appreciate in value over time.

One of the key benefits of investing is the ability to earn compound interest or capital gains. When investments perform well, the returns can be reinvested to generate even greater returns in the future. This snowball effect can significantly contribute to the growth of net worth over the long term.

Joan Lunden Pennbook's investment portfolio likely consists of a diversified mix of assets, each with its own risk and return profile. By carefully managing her investments and making sound financial decisions, she can potentially mitigate risks and maximize returns, which ultimately leads to a higher net worth.

Understanding the connection between investments and net worth is crucial for anyone seeking to build and preserve their wealth. By investing wisely and taking calculated risks, individuals can potentially increase their net worth and achieve financial success.

Income

In the context of net worth of Joan Lunden Pennbook, income represents the inflow of financial resources that contribute to her overall wealth. It encompasses various streams of earnings that collectively impact the growth and stability of her net worth.

- Salary and Wages

As a renowned journalist and television host, Joan Lunden Pennbook likely earns a substantial income from her professional endeavors. Her salary and wages represent a major component of her income and directly contribute to her net worth.

- Investments

Investment returns, such as dividends, interest, and capital gains, can also significantly contribute to Joan Lunden Pennbook's income. By investing wisely and managing her portfolio effectively, she can generate passive income streams that supplement her other earnings.

- Royalties

As an author of several books, Joan Lunden Pennbook may receive royalties from the sale of her publications. Royalties represent a form of income that can provide ongoing financial returns over time.

- Endorsements and Sponsorships

Given her public profile and influence, Joan Lunden Pennbook may engage in endorsement deals or sponsorship agreements with various brands and companies. This type of income can further contribute to her overall financial standing.

By understanding the diverse sources of income that contribute to Joan Lunden Pennbook's net worth, we gain insights into the strategies and financial decisions that have shaped her financial success. Her ability to generate multiple income streams has enabled her to accumulate wealth and secure her financial future.

Expenses

Understanding the relationship between expenses and net worth of Joan Lunden Pennbook is crucial for assessing her financial health and overall wealth management strategies. Expenses represent the outflow of financial resources from her net worth and play a critical role in determining her financial standing and ability to accumulate wealth.

Every expense, no matter how small, reduces Joan Lunden Pennbook's net worth. Essential expenses, such as housing, food, and transportation, are necessary for maintaining a certain standard of living and well-being. However, discretionary expenses, such as entertainment, travel, and luxury purchases, can significantly impact her net worth if not carefully managed.

Analyzing Joan Lunden Pennbook's expenses provides valuable insights into her spending habits, financial priorities, and overall financial management skills. High levels of discretionary spending relative to her income can hinder her ability to save and invest, ultimately affecting her net worth growth. Conversely, prudent expense management and a focus on essential expenses can contribute to a higher net worth over time.

By understanding the cause-and-effect relationship between expenses and net worth of Joan Lunden Pennbook, we can emphasize the importance of financial planning and budgeting. It highlights the significance of controlling discretionary expenses, prioritizing essential expenses, and making informed financial decisions to preserve and grow net worth in the long run.

Cash Flow

Cash flow plays a crucial role in the net worth of Joan Lunden Pennbook. It represents the movement of money in and out of her financial accounts and is a key indicator of her financial health. Managing cash flow effectively is essential for building and preserving wealth.

- Operating Cash Flow

Operating cash flow refers to the cash generated from Joan Lunden Pennbook's core business activities or investments. This includes revenue from sales, interest earned, and dividends received.

- Investing Cash Flow

Investing cash flow represents the cash used to acquire or dispose of assets, such as real estate or stocks. It can impact Joan Lunden Pennbook's net worth by increasing or decreasing the value of her investment portfolio.

- Financing Cash Flow

Financing cash flow involves the movement of cash related to debt or equity financing. This includes proceeds from loans, issuance of bonds, or repayment of debt, and can affect Joan Lunden Pennbook's net worth by altering her liabilities or equity position.

Understanding the components of cash flow allows us to assess Joan Lunden Pennbook's financial performance, liquidity, and overall financial health. By analyzing cash flow statements and comparing them over time, we can gain insights into her ability to generate cash, make sound investment decisions, and manage her financial obligations. The interplay between cash flow and net worth highlights the importance of cash flow management for long-term wealth creation and preservation.

Debt

Debt plays a significant role in the net worth of Joan Lunden Pennbook. It represents borrowed funds that increase her liabilities and can have a profound impact on her overall financial health.

Debt can be a critical component of net worth, particularly when used strategically for investments or business ventures. Joan Lunden Pennbook may utilize debt to acquire assets, such as real estate or stocks, that appreciate in value over time, potentially increasing her net worth. However, it's crucial to manage debt responsibly to avoid excessive interest payments and potential financial distress.

Real-life examples of debt in Joan Lunden Pennbook's net worth could include mortgages on properties she owns, loans taken out for business investments, or personal loans for various purposes. Understanding the types and amounts of debt she holds provides insights into her financial leverage and risk tolerance.

Practically, assessing the relationship between debt and net worth is crucial for making informed financial decisions. By carefully considering the cost of debt, potential returns on investments, and overall financial goals, Joan Lunden Pennbook can optimize her debt utilization to maximize her net worth and long-term financial well-being.

Investment Returns

Investment returns play a significant role in the net worth of Joan Lunden Pennbook as they directly impact the value of her investments and overall financial well-being. Investment returns are the gains or profits derived from various investment vehicles, such as stocks, bonds, or real estate, over a specific period.

Positive investment returns can substantially increase Joan Lunden Pennbook's net worth. For instance, if she invests in a stock that appreciates in value, the increase in stock price represents an investment return that adds to her net worth. Conversely, negative investment returns can decrease her net worth if the value of her investments declines.

Real-life examples of investment returns within Joan Lunden Pennbook's net worth could include dividends received from stock holdings or rental income generated from investment properties. By understanding the relationship between investment returns and her net worth, she can make informed decisions about her investment portfolio and financial strategy.

Financial Management

Financial management is a crucial aspect that shapes the net worth of Joan Lunden Pennbook. It encompasses the strategies, decisions, and actions taken to manage her financial resources effectively. By understanding the key components of financial management, we can gain insights into how Joan Lunden Pennbook has accumulated and preserved her wealth.

- Asset Allocation

Asset allocation involves distributing investments across different asset classes, such as stocks, bonds, and real estate. Joan Lunden Pennbook's asset allocation strategy determines the risk and return profile of her portfolio and can significantly impact her overall net worth.

- Investment Selection

Choosing the right investments is essential for growing net worth. Joan Lunden Pennbook's investment selection process considers factors like market trends, risk tolerance, and potential returns.

- Debt Management

Managing debt wisely is crucial for preserving net worth. Joan Lunden Pennbook's debt management strategy involves decisions on borrowing, debt repayment, and minimizing interest expenses.

- Cash Flow Management

Managing cash flow ensures that Joan Lunden Pennbook has sufficient liquidity to meet financial obligations and pursue investment opportunities. Effective cash flow management helps maintain a healthy financial position.

Overall, financial management plays a vital role in Joan Lunden Pennbook's net worth. By skillfully managing her assets, investments, debt, and cash flow, she has been able to build and sustain her financial success.

In conclusion, exploring the net worth of Joan Lunden Pennbook provides valuable insights into the multifaceted nature of wealth management and financial success. Key elements contributing to her financial standing include strategic asset allocation, prudent investment selection, disciplined debt management, and effective cash flow management.

Understanding the interplay between these components emphasizes the significance of financial planning, informed decision-making, and responsible risk-taking in building and preserving wealth. Joan Lunden Pennbook's journey serves as a reminder that financial well-being is not solely dependent on income or inheritance but rather on the ability to manage resources wisely and make sound financial choices.

- Subhashree Sahu New Mms A Comprehensive Exploration

- Ari Kytsya Onlyfans A Comprehensive Look Into Her Career And Success