Have you ever heard about the dark side of crypto trading? Anon pump n dump is one of the biggest controversies in the crypto world. Imagine this: a group of anonymous traders secretly buying a cheap coin, hyping it up on social media, and then selling it off at a much higher price. It's like a digital version of a pyramid scheme, but way more chaotic and risky. This practice has been around for years, and it continues to thrive despite the efforts to regulate it. If you're curious about how it works and why it's so controversial, you're in the right place.

Let me break it down for you. Anon pump n dump is not just some random trend; it's a calculated strategy used by experienced traders to manipulate the market. These traders, often working in secret groups, use their combined resources to artificially inflate the value of a cryptocurrency. Once the price hits a certain point, they sell their holdings, leaving unsuspecting investors holding the bag. It's a game of cat and mouse, and it's happening right under our noses.

Now, before we dive deeper, let's talk about why this topic matters. If you're into crypto trading, understanding anon pump n dump can help you avoid getting scammed. Even if you're not a trader, it's fascinating to learn how these schemes work and how they impact the market. So, buckle up because we're about to explore the shady world of anon pump n dump and uncover the truth behind it.

- Marie Temara Nudes Debunking Myths And Exploring The Truth

- Alana Cho Nudes Debunking Myths And Understanding Privacy In The Digital Age

What Exactly is Anon Pump N Dump?

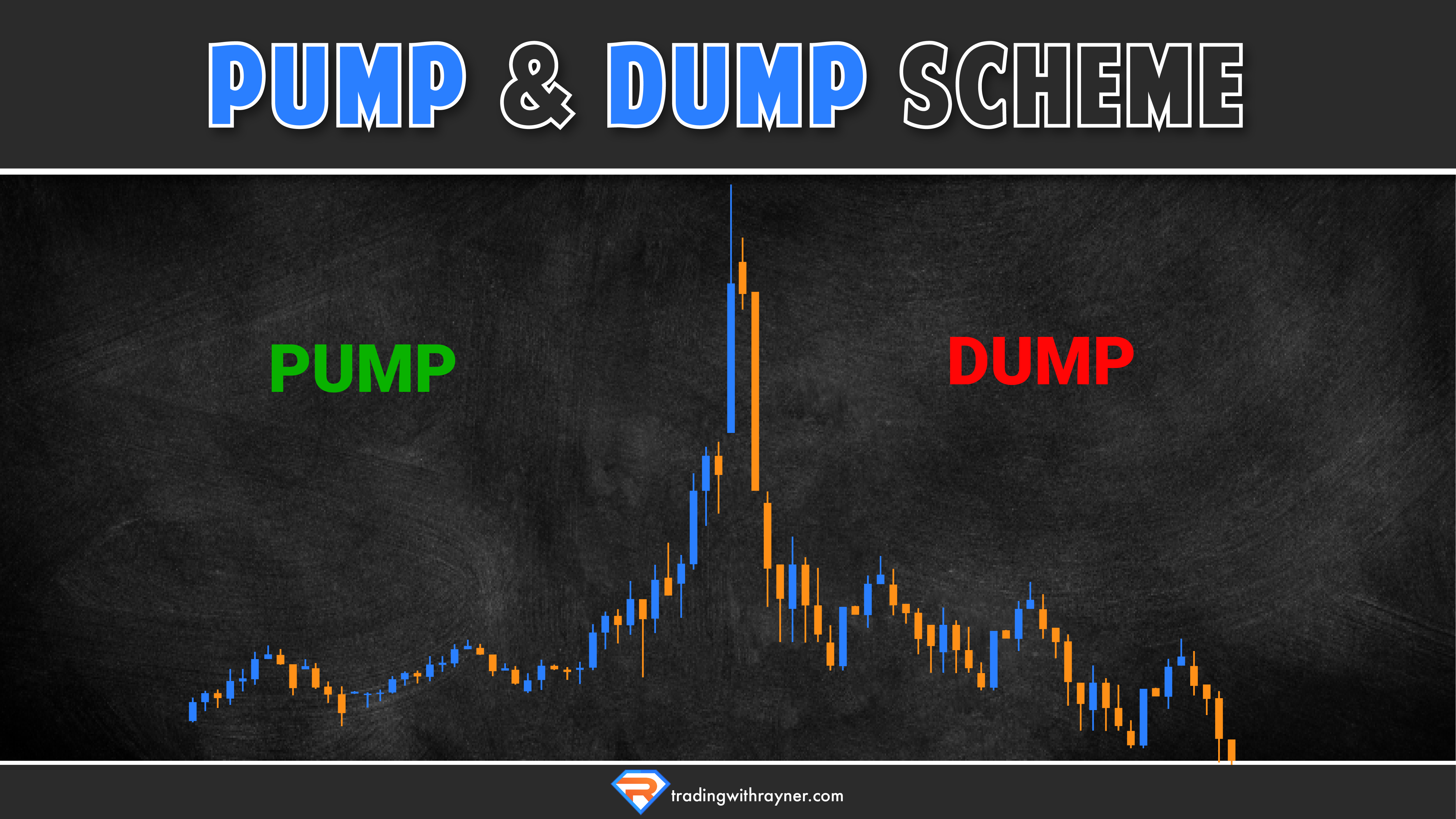

Let's start with the basics. Anon pump n dump is a scheme where a group of traders, usually anonymous, work together to manipulate the price of a cryptocurrency. They buy a coin in large quantities while spreading false information to create hype. Once the price spikes, they sell their holdings, leaving other investors with worthless coins. It's a high-risk, high-reward strategy that can lead to massive profits—or massive losses.

Here's the kicker: these groups often operate in secret Telegram channels or Discord servers. Members pay to join, and once inside, they receive instructions on which coins to buy and when to sell. It's like a private club where everyone is in on the scam. The anonymity of the internet makes it easy for these groups to operate without fear of repercussions.

How Does Anon Pump N Dump Work?

Now that we know what it is, let's dive into the mechanics. The process starts with the group identifying a low-cap coin with little trading volume. They buy it in large quantities, driving up the price. Meanwhile, they spread misinformation on social media platforms, claiming that the coin is about to explode in value. Unsuspecting investors jump on the bandwagon, further driving the price up. Once the price reaches a certain point, the group sells their holdings, causing the price to crash.

- Jasi Bae Naked A Comprehensive Exploration

- Subhashree Sahu Nude Debunking Myths And Understanding The Impact On Personal Privacy

- Step 1: Identify a low-cap coin with little trading volume.

- Step 2: Buy the coin in large quantities, driving up the price.

- Step 3: Spread misinformation on social media to create hype.

- Step 4: Sell the holdings once the price spikes, causing it to crash.

It's a vicious cycle that can happen multiple times a day. Some groups even have scheduled pumps, where members know exactly when to buy and sell. It's a well-oiled machine designed to exploit the ignorance of new traders.

Why is Anon Pump N Dump Controversial?

There's a reason why anon pump n dump is frowned upon in the crypto community. First and foremost, it's a form of market manipulation, which is illegal in many countries. By artificially inflating the price of a coin, these groups create a false sense of value, leading to uninformed investors losing money. It's not just about making a quick buck; it's about exploiting the trust of others for personal gain.

Moreover, anon pump n dump undermines the integrity of the crypto market. It creates volatility and uncertainty, making it harder for legitimate investors to make informed decisions. Imagine spending months researching a coin, only to have its price manipulated by a group of anonymous traders. It's frustrating, to say the least.

Legal Implications of Anon Pump N Dump

Speaking of legality, let's talk about the legal implications of anon pump n dump. In the United States, for example, market manipulation is illegal under securities law. The Securities and Exchange Commission (SEC) has taken action against individuals and groups involved in such schemes. However, enforcing these laws in the crypto space is challenging due to the decentralized nature of blockchain technology.

Other countries have similar laws, but enforcement varies. Some countries have stricter regulations, while others have more lenient ones. This creates a gray area where anon pump n dump can thrive. As the crypto market continues to grow, it's likely that we'll see more efforts to regulate these practices.

The Impact of Anon Pump N Dump on the Market

Now, let's talk about the impact of anon pump n dump on the crypto market. These schemes contribute to market volatility, making it difficult for legitimate investors to make informed decisions. When a coin's price is artificially inflated, it creates a false sense of value, leading to irrational investment decisions. This, in turn, can lead to market crashes and a loss of trust in the crypto ecosystem.

Moreover, anon pump n dump can discourage new investors from entering the market. If they see the market as a place where scams are rampant, they may choose to stay away altogether. This can stifle innovation and growth in the crypto space, which is something we all want to avoid.

How to Identify an Anon Pump N Dump Scheme

So, how can you identify an anon pump n dump scheme? There are a few red flags to watch out for. First, be wary of coins with sudden, unexplained price spikes. If a coin's price increases dramatically in a short period of time, it could be a sign of manipulation. Second, look out for excessive hype on social media. If you see a coin being promoted heavily on Twitter or Reddit, it could be part of a pump n dump scheme.

- Red Flag 1: Sudden, unexplained price spikes.

- Red Flag 2: Excessive hype on social media.

- Red Flag 3: Low trading volume before the price spike.

- Red Flag 4: Lack of fundamental value in the coin.

By staying vigilant and doing your own research, you can avoid falling victim to these schemes. It's all about being informed and making smart investment decisions.

How to Protect Yourself from Anon Pump N Dump

Now that you know how to identify an anon pump n dump scheme, let's talk about how to protect yourself. The first step is to do your own research. Don't rely on social media hype or groupthink to make investment decisions. Look at the fundamentals of the coin, such as its use case, team, and roadmap. If a coin doesn't have a solid foundation, it's probably not worth investing in.

Second, diversify your portfolio. Don't put all your eggs in one basket. If you spread your investments across multiple coins, you reduce the risk of losing everything in a single pump n dump scheme. It's like playing the lottery; the more tickets you have, the better your chances of winning.

Tools and Resources for Identifying Pump N Dump Schemes

There are several tools and resources available to help you identify pump n dump schemes. One of the most popular is CoinMarketCap, which provides real-time data on cryptocurrency prices and trading volumes. Another useful tool is TradingView, which offers advanced charting features and technical analysis tools. By using these tools, you can spot suspicious activity and avoid getting caught in a scheme.

Additionally, there are several communities and forums where traders share information about potential pump n dump schemes. Reddit's r/CryptoCurrency subreddit is a great place to start. Just remember to take everything you read with a grain of salt and do your own research before making any investment decisions.

Case Studies: Real-Life Examples of Anon Pump N Dump

To better understand how anon pump n dump works, let's look at some real-life examples. One of the most famous cases is the Bitconnect scandal. Bitconnect was a cryptocurrency lending platform that promised high returns to investors. However, it was later revealed to be a massive pump n dump scheme, with the founders cashing out and leaving investors with worthless coins.

Another example is the Ethereum Classic pump n dump in 2019. A group of traders coordinated a pump on Ethereum Classic, driving the price up by over 100% in a matter of hours. Once the price reached a certain point, they sold their holdings, causing the price to crash. These examples highlight the dangers of anon pump n dump and the importance of being vigilant.

Lessons Learned from Past Scams

From these case studies, we can learn several valuable lessons. First, always do your own research. Don't rely on social media hype or groupthink to make investment decisions. Second, be skeptical of coins that promise unrealistic returns. If it sounds too good to be true, it probably is. Third, diversify your portfolio to reduce risk. By following these principles, you can protect yourself from falling victim to future scams.

The Future of Anon Pump N Dump

As the crypto market continues to evolve, so too will the tactics used by anon pump n dump groups. With the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs), we're likely to see new forms of market manipulation emerge. However, regulators are also becoming more aware of these practices and are taking steps to combat them.

One potential solution is the use of blockchain analytics tools to track suspicious activity. These tools can help identify pump n dump schemes in real-time, allowing exchanges to take action before the damage is done. Additionally, increased regulation and enforcement could deter groups from engaging in these practices.

What Can You Do to Help?

As a trader, you have a role to play in combating anon pump n dump. By staying informed and sharing your knowledge with others, you can help create a more transparent and trustworthy crypto market. Report suspicious activity to exchanges and regulators, and encourage others to do the same. Together, we can make the crypto space a safer place for everyone.

Conclusion: The Bottom Line on Anon Pump N Dump

In conclusion, anon pump n dump is a controversial practice that continues to thrive in the crypto space. While it can lead to massive profits for those involved, it also creates volatility and uncertainty in the market. By understanding how these schemes work and taking steps to protect yourself, you can avoid falling victim to them.

So, what can you do? First, do your own research and don't rely on social media hype. Second, diversify your portfolio to reduce risk. Third, stay informed and share your knowledge with others. Together, we can make the crypto market a safer and more transparent place for everyone.

Before you go, I want to leave you with a call to action. If you found this article helpful, please share it with your friends and colleagues. The more people who are informed about anon pump n dump, the better. And if you have any questions or comments, feel free to leave them below. Let's keep the conversation going!

Table of Contents

- What Exactly is Anon Pump N Dump?

- How Does Anon Pump N Dump Work?

- Why is Anon Pump N Dump Controversial?

- Legal Implications of Anon Pump N Dump

- The Impact of Anon Pump N Dump on the Market

- How to Identify an Anon Pump N Dump Scheme

- How to Protect Yourself from Anon Pump N Dump

- Tools and Resources for Identifying Pump N Dump Schemes

- Case Studies: Real-Life Examples of Anon Pump N Dump

- The Future of Anon Pump N Dump