Let’s face it, folks—taxes can be a real headache. Whether you're an individual trying to make sense of your personal finances or a business owner juggling multiple financial obligations, decrypted tax is the key to unlocking clarity in this often confusing world. In today’s fast-paced economy, understanding how taxes work isn’t just a good idea—it’s essential. So, buckle up because we’re about to dive deep into the world of decrypted tax and make it all crystal clear!

Taxes are like that one friend who always shows up uninvited but never leaves. You can’t avoid them, and they have a way of complicating things when you least expect it. But what if I told you there’s a way to simplify the whole process? Decrypted tax is all about breaking down those complex tax jargons into bite-sized chunks that even your grandma could understand. It’s about empowering you with knowledge so you can take control of your financial destiny.

Now, before we get into the nitty-gritty, let me assure you this isn’t going to be one of those snooze-worthy articles filled with endless legal terms and boring graphs. Nope, we’re keeping it real, conversational, and—dare I say—fun. So grab a cup of coffee, sit back, and let’s demystify the world of decrypted tax together.

- Baldwin Brothers Exploring The Legacy Of Hollywoods Most Talented Siblings

- Miaz Girthmaster The Ultimate Guide To Understanding And Maximizing Your Potential

What Exactly Is Decrypted Tax?

Alright, let’s start with the basics. Decrypted tax refers to the process of simplifying and demystifying the often-confusing world of taxation. It’s not just about filling out forms or paying Uncle Sam his fair share; it’s about understanding why you’re paying what you’re paying and how you can optimize your tax strategy to keep more money in your pocket.

Think of decrypted tax as the decoder ring for all things financial. It helps you navigate through the labyrinth of tax laws, deductions, and credits, ensuring you’re not overpaying or missing out on potential savings. In a world where taxes can feel like a mystery novel with no ending, decrypted tax is your trusty detective, piecing together the clues to solve the puzzle.

Why Should You Care About Decrypted Tax?

Here’s the deal: if you’re breathing, you’re paying taxes. From the moment you earn your first paycheck to the time you buy that dream house, taxes are there, lurking in the shadows. But here’s the kicker—how much you pay and how you manage those payments can have a significant impact on your financial well-being.

- Brandi Passante Nude Pics A Comprehensive Analysis And Understanding

- Erome Sophie Rain The Rising Star In The Digital Age

By decrypting your taxes, you’re not just saving money; you’re gaining peace of mind. Imagine knowing exactly where your money is going and why. That’s the power of decrypted tax. It’s about taking control of your finances and making informed decisions that align with your goals and aspirations.

Decrypted Tax: The Key to Financial Freedom

Financial freedom—it’s a term we throw around a lot, but what does it really mean? For most people, it means having the ability to live life on their own terms without being shackled by financial burdens. And guess what? Decrypted tax plays a crucial role in achieving that freedom.

When you understand how taxes work and how to optimize them, you’re essentially giving yourself a financial raise. You’re freeing up more money to invest in your future, whether that’s buying a home, starting a business, or simply enjoying the finer things in life. Decrypted tax isn’t just about compliance; it’s about empowerment.

The Benefits of Decrypted Tax

- Increased Savings: By understanding deductions and credits, you can significantly reduce your tax liability.

- Improved Financial Planning: Knowing your tax obligations helps you plan better for the future.

- Reduced Stress: Let’s face it, tax season can be stressful. Decrypted tax takes the guesswork out of the equation.

- Enhanced Compliance: Staying on top of your taxes ensures you’re always in good standing with the IRS.

Common Tax Myths Debunked

There’s a lot of misinformation out there when it comes to taxes. From believing that all tax deductions are created equal to thinking that you can avoid taxes altogether, these myths can lead to costly mistakes. Let’s debunk some of the most common ones:

Myth #1: All Deductions Are the Same

Not all deductions are created equal. Some are more valuable than others, and understanding the difference can save you a ton of money. For example, itemized deductions can often provide greater savings than the standard deduction, depending on your specific situation.

Myth #2: You Can Avoid Taxes Entirely

Sorry, folks, but this one’s a big fat lie. While there are legitimate ways to reduce your tax burden, completely avoiding taxes is a recipe for disaster. Stick to legal strategies and leave the shady tactics to the movies.

Decrypted Tax Strategies for Individuals

Whether you’re a single filer, married, or have a growing family, there are decrypted tax strategies tailored to your specific needs. Let’s break them down:

Single Filers

If you’re flying solo, there are plenty of ways to optimize your taxes. From taking advantage of the standard deduction to exploring education credits, there’s no shortage of opportunities to save.

Married Couples

Marriage brings its own set of tax considerations. Decrypted tax for married couples often involves deciding whether to file jointly or separately, which can have a significant impact on your tax liability.

Families with Children

Having kids comes with its own set of tax benefits, from the Child Tax Credit to dependent care assistance. Decrypted tax for families is all about maximizing these benefits to ease the financial burden of raising children.

Decrypted Tax for Businesses

Business owners have a unique set of tax challenges and opportunities. From deducting business expenses to understanding the implications of different business structures, decrypted tax is crucial for maximizing profitability.

Small Business Owners

Running a small business is no easy feat, but with the right tax strategies, you can keep more of your hard-earned money. Decrypted tax for small businesses often involves tracking expenses meticulously and taking advantage of available credits and deductions.

Freelancers and Contractors

Freelancers and contractors operate in a world of their own when it comes to taxes. Decrypted tax for this group focuses on understanding self-employment taxes, deducting home office expenses, and planning for quarterly tax payments.

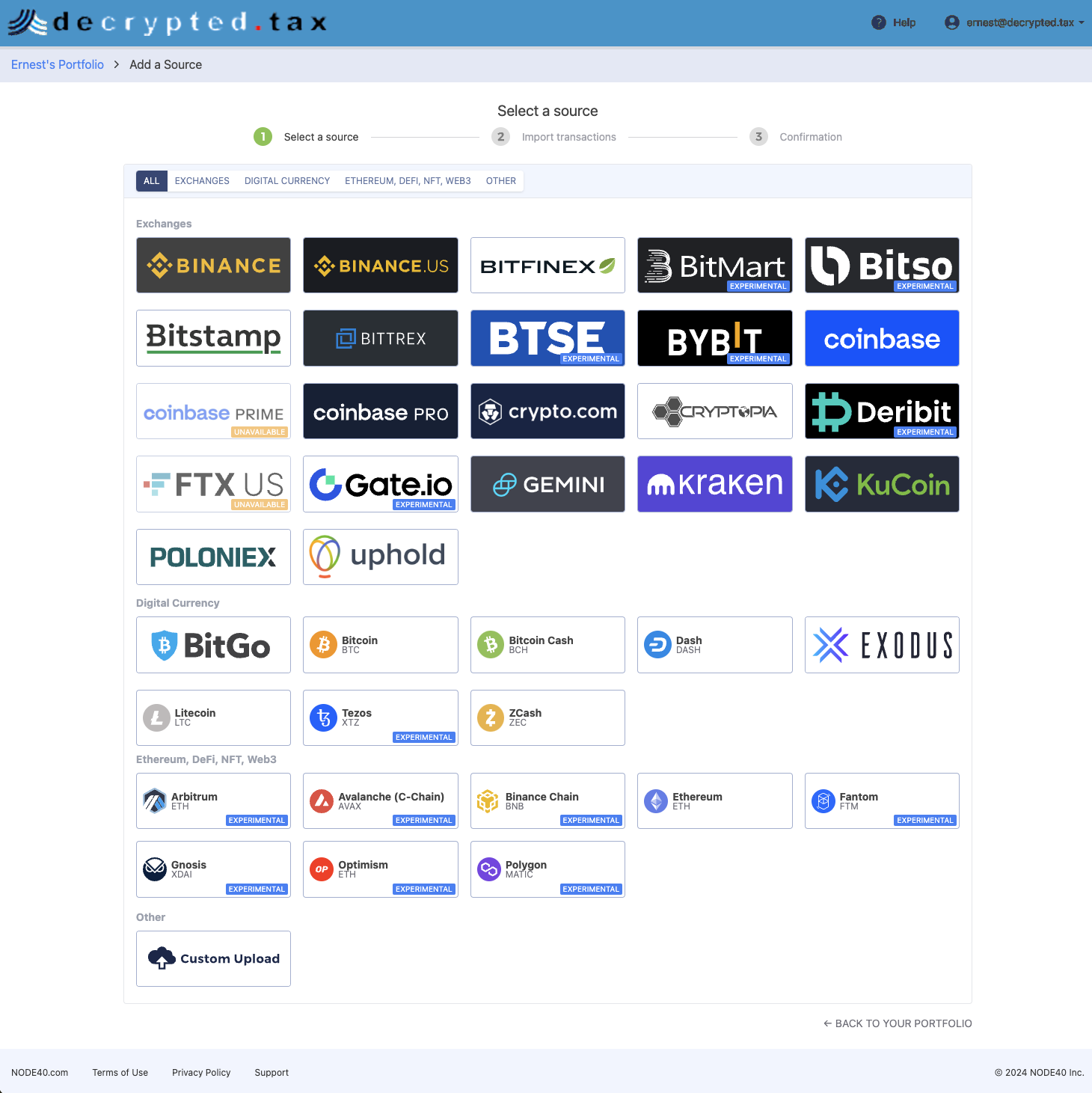

Tools and Resources for Decrypted Tax

In today’s digital age, there’s no shortage of tools and resources to help you decrypt your taxes. From tax software to online calculators, here are some of the best options:

- Tax Software: Programs like TurboTax and H&R Block make filing your taxes a breeze.

- Online Calculators: Use these to estimate your tax liability and plan accordingly.

- IRS Website: The official IRS site is a treasure trove of information for all things tax-related.

Decrypted Tax and the Future

As the world continues to evolve, so too does the landscape of taxation. From changes in tax laws to advancements in technology, staying informed is more important than ever. Decrypted tax is your ticket to navigating these changes with confidence and ease.

Trends to Watch

Keep an eye on emerging trends such as the rise of digital currencies and their tax implications, as well as potential changes in tax legislation. Staying ahead of the curve will ensure you’re always prepared for whatever the future holds.

Conclusion: Take Control of Your Taxes Today

In conclusion, decrypted tax isn’t just about compliance; it’s about empowerment. By understanding how taxes work and how to optimize them, you’re taking a crucial step towards financial freedom. So, what are you waiting for? Start decrypting your taxes today and take control of your financial destiny.

Don’t forget to leave a comment below and share this article with your friends. Together, let’s make decrypted tax a household term and help everyone take charge of their finances. Until next time, stay savvy and keep those taxes in check!

Table of Contents

- What Exactly Is Decrypted Tax?

- Why Should You Care About Decrypted Tax?

- Decrypted Tax: The Key to Financial Freedom

- Common Tax Myths Debunked

- Decrypted Tax Strategies for Individuals

- Decrypted Tax for Businesses

- Tools and Resources for Decrypted Tax

- Decrypted Tax and the Future

- Conclusion: Take Control of Your Taxes Today